Insurance Marketplace Keep Your Phone and Car Insured.

We bring you a new product! Access insurance for cars and phones, all in one place. Your safety and peace of mind are our priority.

Insurance products are not provided by or affiliated with Community Federal Savings Bank.

MyBambu’s Insurance Marketplace Benefits

All your insurance in one place.

Choose the option that best suits you.

No need to browse multiple sites or make numerous calls for rate comparisons.

Complete everything in a few simple steps.

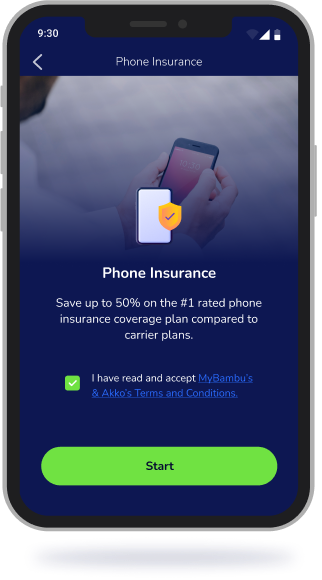

MyBambu’s phone insurance option

Protect your phone against costly damages, breakdowns, and theft. With easy and fast local repairs.

Find affordable options for your phone coverage.

Keep going knowing you’re fully protected from whoops, oh-no’s, and not agains.

Quick Repairs Available – Often Same Day.

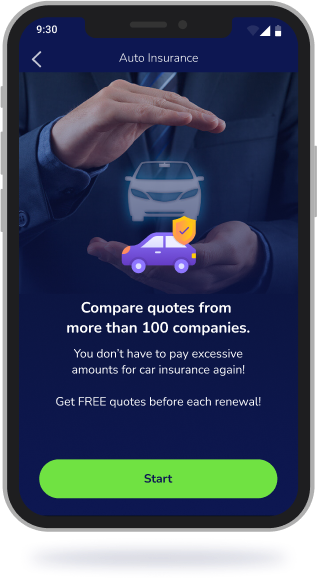

MyBambu's auto insurance option

Mybambu makes it easy to find you perfect policy. Discover peace of mind with better insurance and better service.

Explore budget-friendly choices for insuring your car.

Compare 100 million+ car insurance quotes to unlock their best rates.

Hassle free, no commitment quotes.

Getting a Insurance Marketplace policy is simple with MyBambu.

Easily obtain an insurance policy with MyBambu. Let us guide you!

Download MyBambu App

Find us on Google Play or the App Store and download the app.

Tap on the Insurance Marketplace tile

Tap on the Insurance Marketplace button in the main menu.

Choose the Item you want to insure.

Select the between phone or car insurance.

Accept terms and conditions

Checkmark you’ve read and accept the terms and conditions box.

Follow the step by step

Keep Going to Obtain Custom Policies for Your Needs.

Watch How to apply for your insurances

Common Questions

Insurance Marketplace

“The quickest way to pay your premium is through your insurance company’s website. You can find direct links to payment portals for major insurers on the insurance provider’s website.

Log in to your insurer’s customer portal to pay your bill and set up automatic payments, or make a one-time payment without needing an account. Most companies also accept payments over the phone or by mail.”

Plans cannot be shared with friends, family members, or anyone else. All plans are per individual and will only cover items that the account holder owns. All accounts may have up to one (1) phone on them. To add more phones, you must purchase additional plans. See insurance provider website for additional details.

Yes! It does not matter what carrier you use or if your phone is unlocked or financed. No matter which plan you choose, your unlocked phone will be protected against Accidental Damage & Theft. When you register, the same process applies for adding your phone to your account. You will take pictures of its front and back to verify its working and undamaged condition.

“The due date will vary depending on when you acquired your coverage and your insurance company. Typically, auto insurers allow you to pay your auto insurance premium in full or split your bill into installments or monthly payments. You can find the due date for your payment on your insurer’s customer portal.

Some insurance companies offer a grace period for missed payments. You may still have time to secure your policy if you’re a few days late on your due date. However, we recommend setting up automatic payments to avoid any interruption in coverage.”

“You can download your digital insurance identification card through your insurance company’s website or app. Find a link to your insurer’s website and additional details on the insurance provider’s website.

Your insurance identification card serves as proof of coverage. Your insurer will mail you a paper identification card along with your insurance declaration. If you lose your card, your insurance company will send another copy upon request. A digital identification card is valid as proof of insurance in all states except New Mexico.”